Cedar Home Loan Blog

Stay updated with the latest news and insights about home loans and the real estate market.

All Articles

Telluride Mortgage Guide 2025: Local Loan Options and Tips

A practical guide to securing a mortgage in Telluride. Learn which loan products work best in high-altitude markets and how to strengthen your application.

Vail Mortgage Strategies: VA and Jumbo Loans in 2025

Understand how VA and Jumbo loans work in Vail and the surrounding Eagle County market, including qualification and appraisal nuances.

Boulder First-Time Buyer Checklist: 2025 Edition

A simple, actionable checklist for first-time buyers in Boulder. From budgeting and credit to inspections and closing.

Summit County Second-Home Financing: What to Know in 2025

Key considerations for financing second homes in Summit County, including occupancy rules and reserve requirements.

The Ins and Outs of Mortgage Broker Fees: What You Need to Know

Understanding mortgage broker fees is crucial for making informed decisions about your home loan. Learn about different fee structures, what's negotiable, and how to ensure you're getting fair value for the services provided.

Identifying Red Flags: Signs of a Bad Mortgage Broker

Learn how to protect yourself from unscrupulous mortgage brokers by identifying key warning signs. Discover what separates reputable brokers from those who may not have your best interests at heart.

10 Ways to Expedite the Mortgage Closing Process

Discover proven strategies to speed up your mortgage closing process. Learn expert tips for preparing documentation, working with professionals, and avoiding common delays to get into your new home faster.

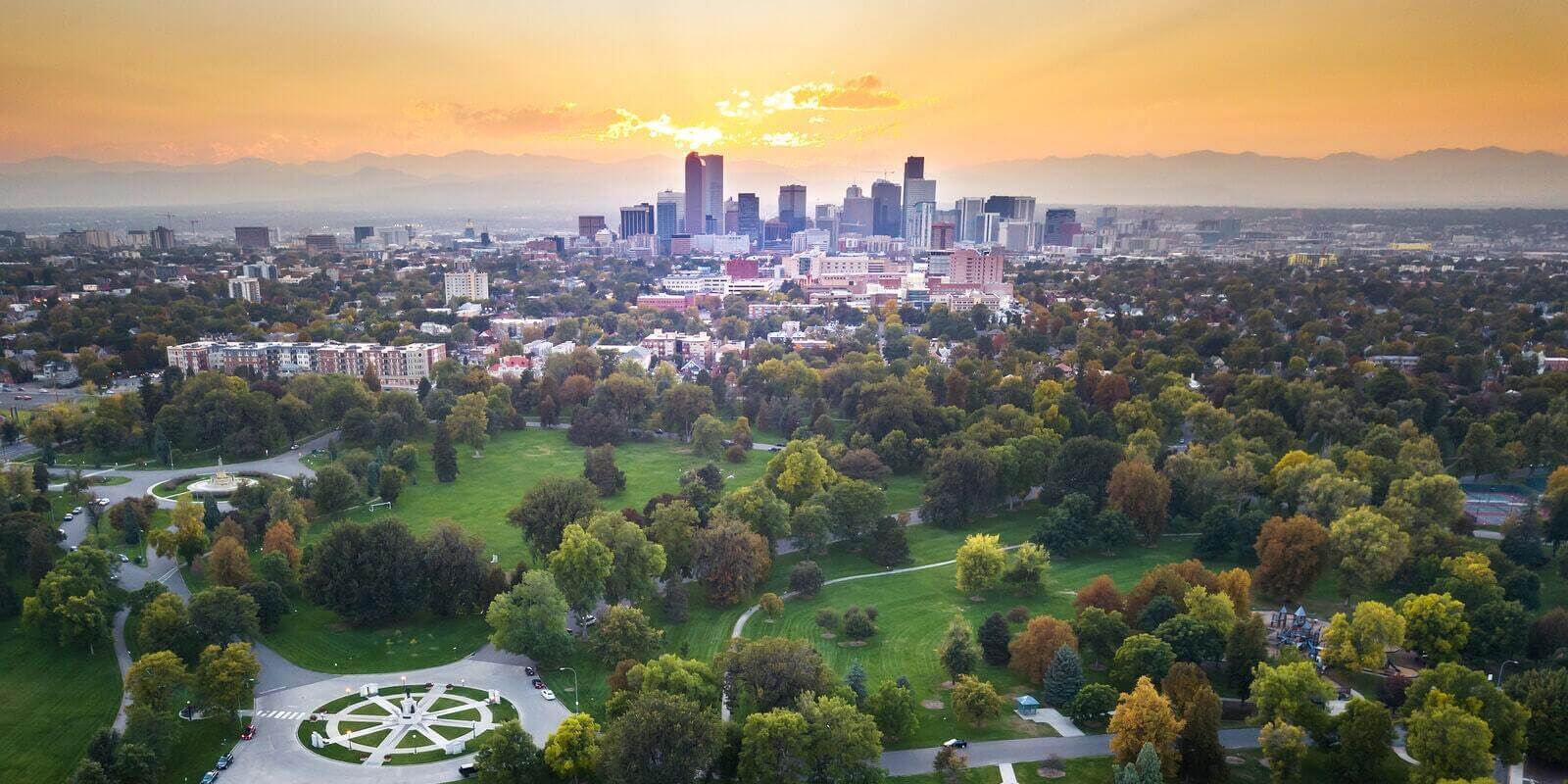

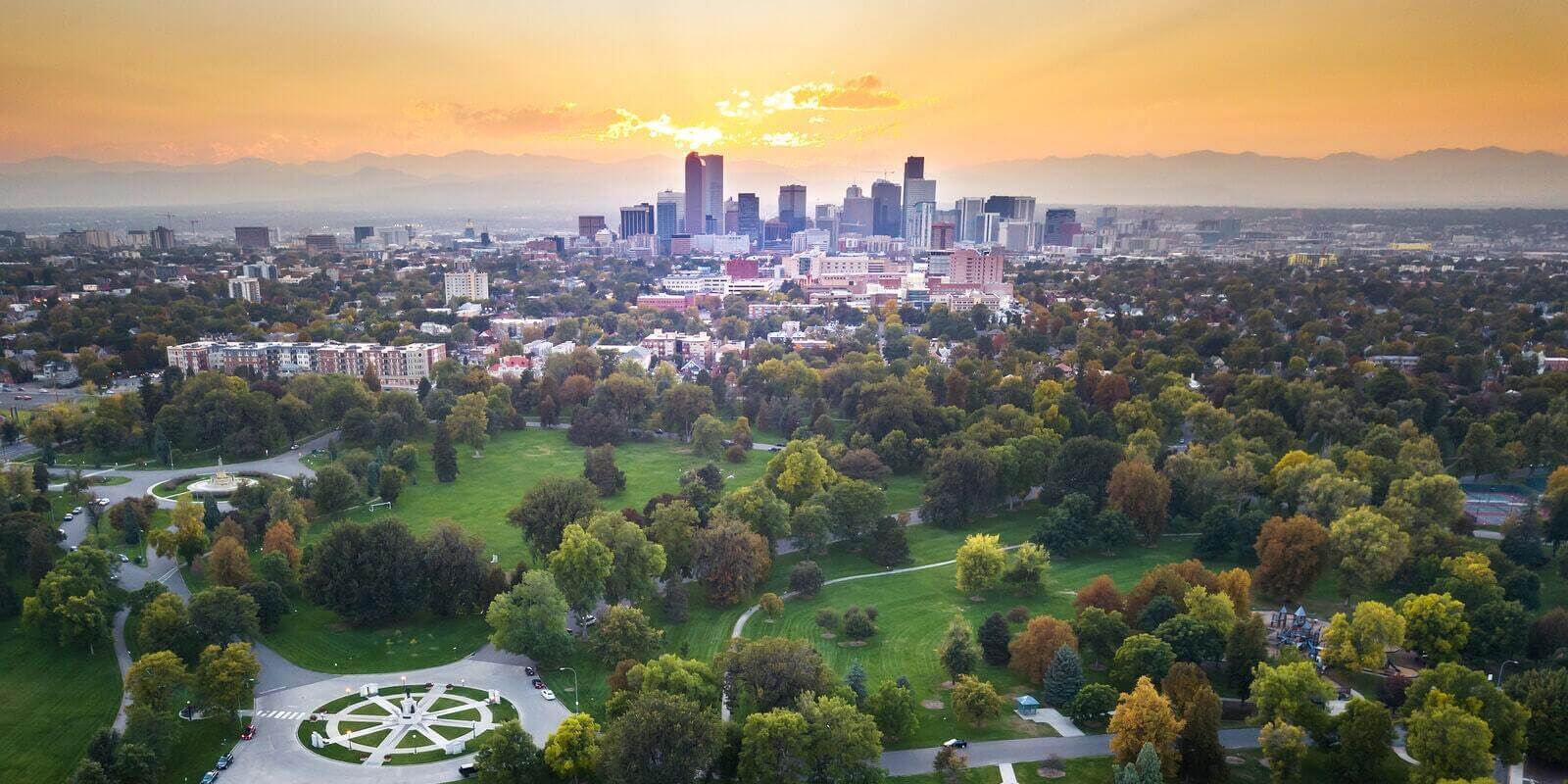

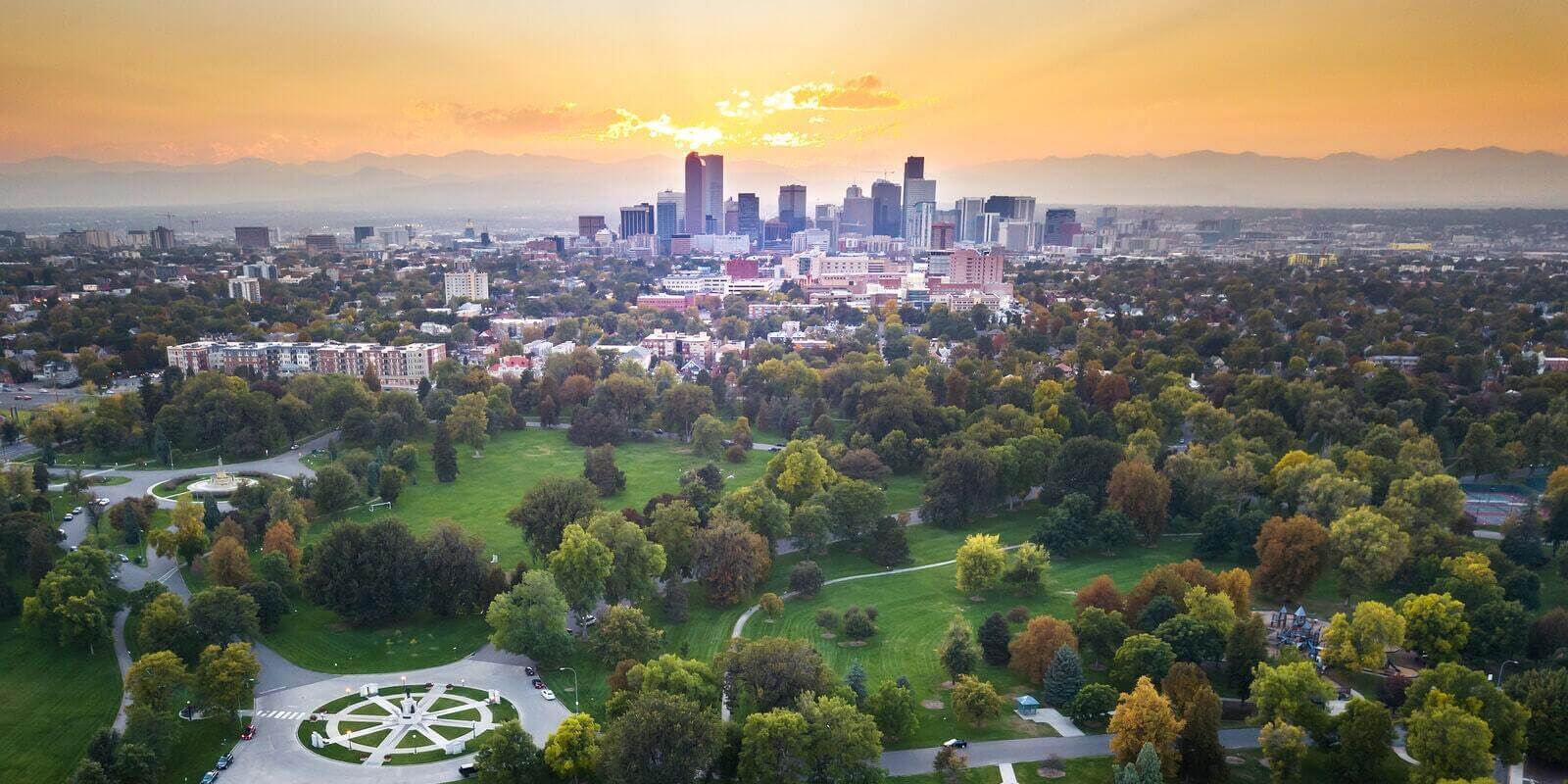

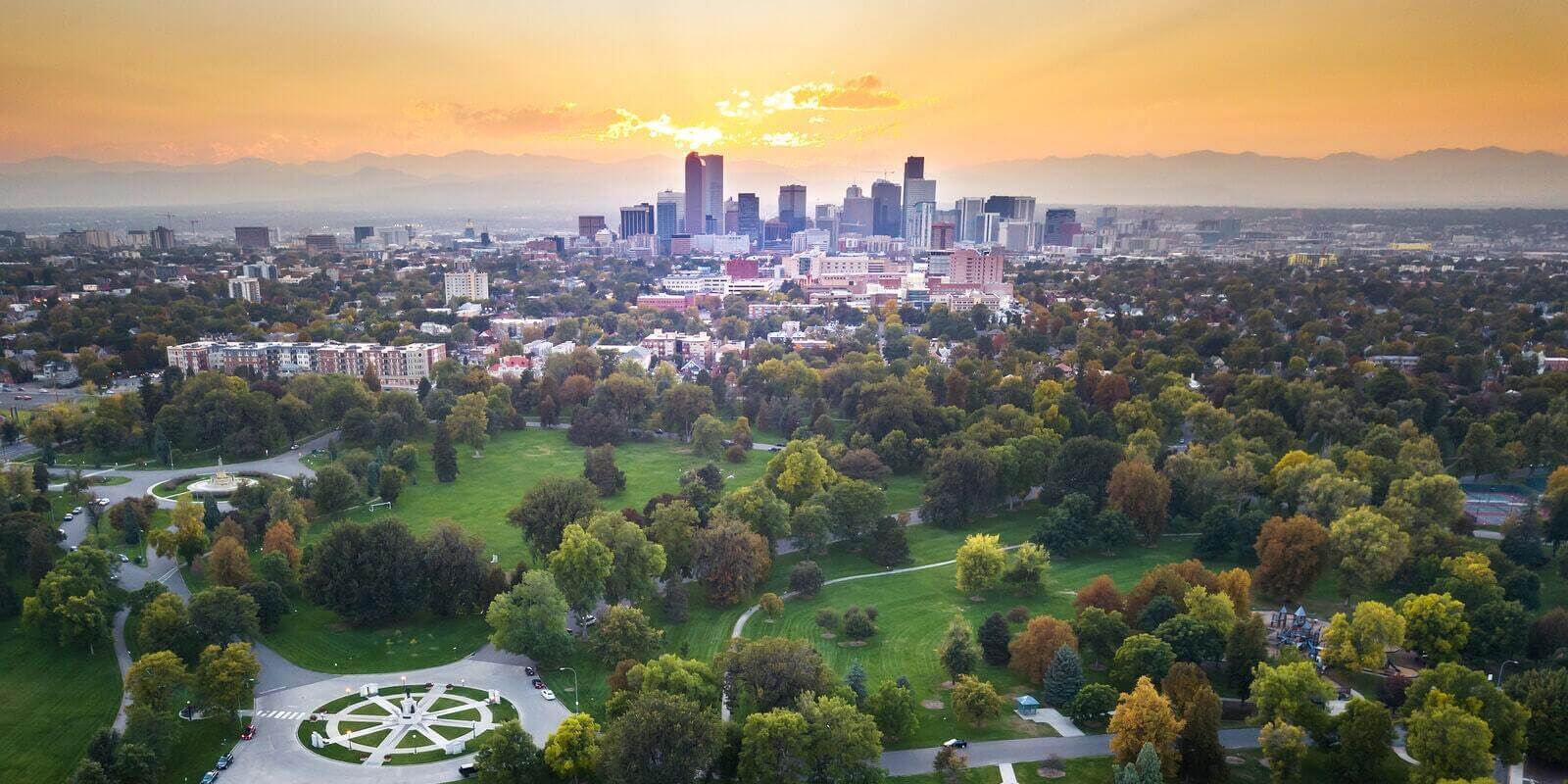

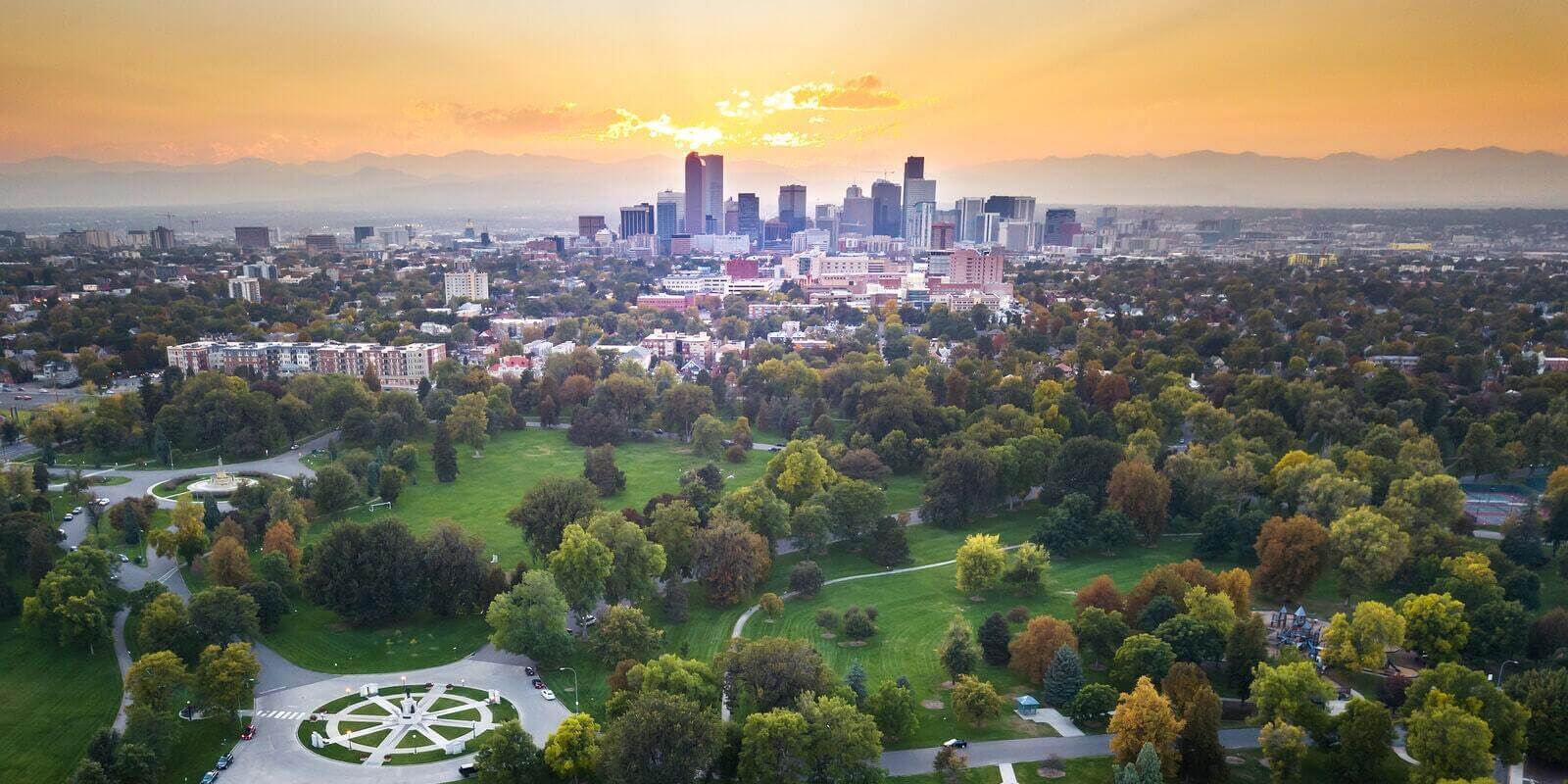

2025 Colorado Spring Market Outlook: What Buyers Need to Know

Comprehensive analysis of Colorado's spring 2025 housing market, including price trends, buyer demographics, and financing options. Learn how stabilizing interest rates and increasing inventory are creating new opportunities for mountain property buyers.

The AI Revolution in Mortgage Approvals: Colorado's Digital Lending Landscape

Artificial intelligence is transforming the mortgage approval process in Colorado, leading to faster, more accurate, and efficient lending. Learn about the benefits and implications of AI-powered mortgage applications.

Green Financing Options for Sustainable Mountain Homes

Discover various financing options available for eco-conscious homebuyers in Colorado's mountain regions. Explore green mortgages, solar panel financing, and other incentives for sustainable mountain properties.

Investment Opportunities in Colorado's Mountain Communities 2025

Explore the lucrative investment opportunities in Colorado's thriving mountain real estate market. Discover promising areas for both short-term rentals and long-term appreciation.

First-Time Homebuyer's Guide to Colorado's Mountain Markets 2025

A comprehensive guide for first-time homebuyers navigating Colorado's competitive mountain real estate market. Learn about essential steps, financing options, and key considerations for a successful purchase.

Navigating Jumbo Loans in Colorado's Luxury Market 2025

Understand the intricacies of jumbo loans and their application to Colorado's luxury mountain properties. Learn about qualification requirements, down payment options, and current interest rate trends.

2025 Vacation Home Financing Trends in Colorado

Explore the latest financing options and market trends for vacation homes in Colorado's mountain communities. Learn about short-term rental considerations and investment potential.

Smart Refinancing Strategies for Colorado Homeowners in 2025

Explore strategic refinancing options for Colorado homeowners in 2025. Learn how to leverage lower interest rates, access home equity, and consolidate debt.

Construction Loans for Mountain Homes: 2025 Guide

Learn about the intricacies of construction loans for mountain homes in Colorado. Understand loan types, draw schedules, and builder requirements for a smooth building process.

Mountain Property Mortgage Insurance: 2025 Update

Understand the complexities of mortgage insurance for mountain properties in Colorado. Learn about PMI requirements, removal options, and strategies to minimize costs.

Remote Work's Continued Impact on Colorado Mountain Real Estate

Analyze the ongoing impact of remote work on Colorado's mountain real estate market. Discover how this trend is shaping property demand, values, and community development.

Optimizing Your Credit Score for Mountain Property Purchase

Learn how to optimize your credit score to secure the best mortgage terms for your mountain property purchase. Discover strategies for improving your creditworthiness.

2025 Property Tax Considerations for Colorado Mountain Homes

Understand the property tax implications of owning a mountain home in Colorado. Learn about assessment methods, rate variations, and tax planning strategies.

2025 Down Payment Assistance Programs in Colorado

Discover various down payment assistance programs available to Colorado homebuyers in 2025. Learn about eligibility requirements, application processes, and available resources.

Winter 2025 Colorado Mountain Real Estate Market Analysis

A comprehensive analysis of the winter 2025 Colorado mountain real estate market, including seasonal trends, price movements, and buyer demographics.

FHA Loans for Mountain Properties: A Complete Guide 2025

Everything you need to know about using FHA loans to purchase mountain properties in Colorado. Learn about eligibility, requirements, and special considerations for high-altitude homes.

VA Loans for Colorado Veterans: Mountain Home Financing 2025

A comprehensive guide to VA loans for veterans looking to purchase mountain properties in Colorado. Understand the benefits, requirements, and process of using your VA benefits.

Using HELOCs for Mountain Property Improvements 2025

Learn how to leverage your mountain home's equity through a HELOC. Discover strategies for home improvements, renovations, and managing seasonal maintenance costs.

Strategic Rate Lock Decisions for Mountain Property Buyers 2025

Master the art of rate lock timing for your mountain property purchase. Learn about rate lock periods, float-down options, and strategies for securing the best rate.

Self-Employed Mortgage Guide for Mountain Property Buyers 2025

Navigate the mortgage process as a self-employed buyer in Colorado's mountain communities. Learn about documentation requirements, qualification strategies, and lender expectations.

Foreign Buyer's Guide to Colorado Mountain Properties 2025

Essential guide for international buyers looking to purchase mountain properties in Colorado. Learn about financing options, legal considerations, and the buying process.

Multi-Family Property Financing in Colorado Mountains 2025

Complete guide to financing multi-family properties in Colorado's mountain communities. Learn about loan options, investment strategies, and market analysis.

Renovation Loan Options for Mountain Properties 2025

Explore renovation loan options for mountain properties in Colorado. Learn about FHA 203(k), HomeStyle, and other renovation financing solutions.

Energy Efficient Mortgages for Mountain Properties 2025

Discover how Energy Efficient Mortgages can help finance sustainable mountain homes. Learn about qualifying improvements, benefits, and application processes.

Mountain Investment Property Strategies 2025

Master the art of mountain property investment in Colorado. Learn about financing strategies, market analysis, and maximizing returns on investment properties.

Summit and Eagle County Home Loans: What You Need to Know

Navigating the unique challenges and opportunities of financing a home in Summit and Eagle Counties requires specialized knowledge. Learn about the specific loan options, requirements, and strategies for securing the best mortgage in these Colorado mountain communities.

Planning Ahead: How to Create an Effective Construction Timeline

Embarking on a construction project? A well-structured timeline is your blueprint for success. Learn how to create a construction timeline that keeps your project on track, within budget, and aligned with your vision.